A National Community Development Financial Institution (CDFI)Flexible Loan Capital Customized to Create Affordable Housing

CHC Social Impact

At CHC, we are dedicated to improving access to the social benefits of affordable homes and rentals for families across the country.

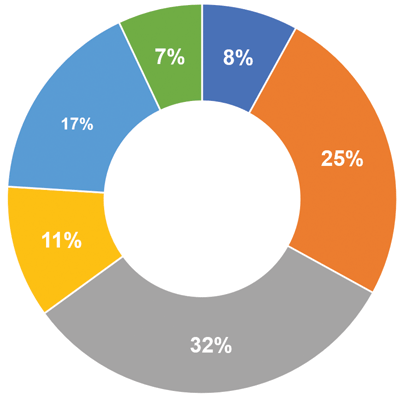

Housing affordability

Our market presence helps preserve and increase the supply of quality affordable housing. By providing affordable, flexible financing to affordable housing developers, we help make access to housing across the nation more attainable for low- and moderate-income borrowers and renters. Affordability levels have both Federal and State definitions. There are generally three levels defined under “low-income households" based on the Area Median Income (AMI): Low Income (at or below 80% of AMI) Very Low Income (at or below 50% of AMI) Extremely Low Income (at or below 30% of AMI). Our efforts are geared towards financing units that are affordable to families earning up to 80% of Area Median Income.

Units Financed in 2023 by Affordability

|

|

0-30% | AMI | | | Extremely low-income |

|

|

31-50% | AMI | | | Very low-income |

|

|

51-60% | AMI | | | Lower-income |

|

|

61-80% | AMI | | | Low-income |

|

|

81-120% | AMI | | | Moderate-income |

|

|

> 120% | AMI | | | Middle-income and greater |