Page 1

CHC STRIVES TO BUILD HEALTHY, VIBRANT, COMMUNITIES BY CREATING INNOVATIVE CAPITAL SOLUTIONS

THAT HELP INDIVIDUALS AND FAMILIES LIVE, WORK, AND THRIVE

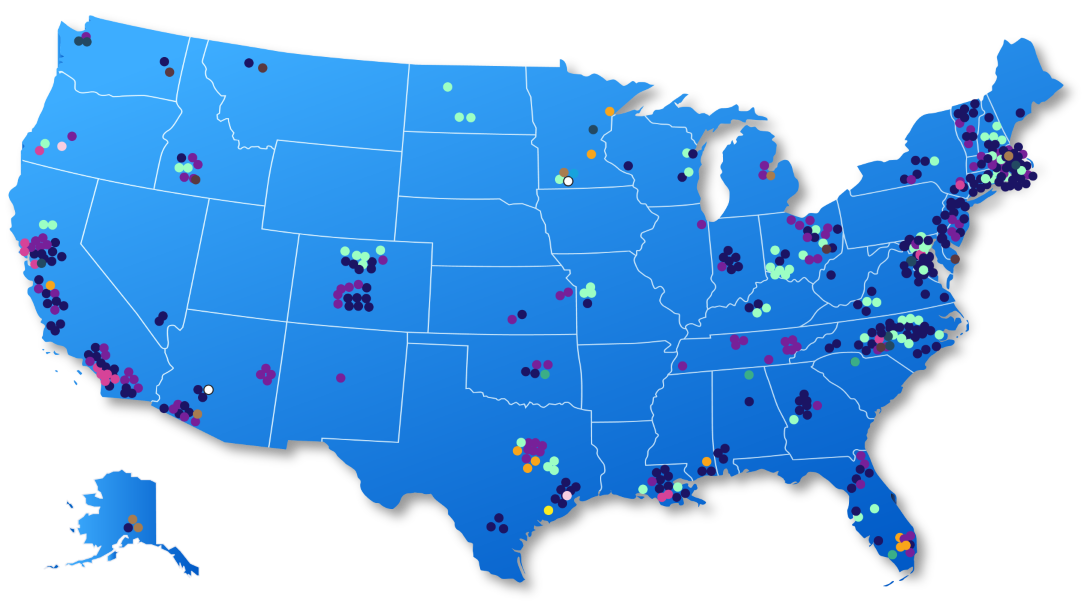

Join us in celebrating 20 years of nationwide lending in partnership with the NeighborWorks® network. As a Community Development Financial Institution (CDFI), CHC provides financing capital to create and preserve all types of affordable housing. From single-family owner-occupancy to multi-family rentals, from properties that serve low-income households exclusively to those that provide housing for a range of incomes. All projects have a common theme: they create or preserve affordable housing opportunities for low-income households. We want to thank our investment and community development partners, and we look forward to the next 20 years of service in support of a quality, affordable place to call home.

Chairman’s Message

Chairman's Message

Creativity. Commitment. Resilience. These qualities have become the defining characteristics of Community Housing Capital over its 20-year history. All of them are important because CHC operates in an environment where community needs, organizational priorities, and financial markets constantly change.

Housing developers in the NeighborWorks® network of community development organizations can choose from many options when considering the best choice for financing. Banks, CDFI’s, and loan funds all compete to win the business of funding NeighborWorks housing developers. Why do so many NeighborWorks organizations pick CHC?

Facilitating Community Development

Facilitating Community Development

Aggregating Capital for 20 Years to Create and Preserve Affordable Housing

The expansion of low- and moderate-income housing is critical for increasing stability and creating pathways to economic prosperity, both for individuals and communities. CHC understands the challenging financial structures that often goes hand-in-hand with affordable housing preservation and development and we work with our developer partners to help provide financing where it is needed. CHC’s flexible, patient, and structured financing facilitates the essential work undertaken by NeighborWorks network members.

We Invest at Scale to Improve Access to Affordable Housing

CHC recognizes that a quality affordable home is the needed underlying support that facilitates all other community development goals such as improved community health, improved educational achievement, stronger local economy, reduced rate of homelessness, reduced crime, increased community resilience, and increased environmental sustainability.

Highlighting some Projects from our First 20 Years.

Strong, Stable Communities are Built on Homeownership

Measuring Our Impact

Measuring Our Impact

CHC strives to build healthy, vibrant communities across the United States by creating innovative capital solutions that help individuals and families live, work, and thrive.

To place the organization’s commitment to building healthy, vibrant communities at the center of its processes, CHC partnered with Pacific Community Ventures (PCV) to develop a quantitative social impact rating tool. The social impact rating tool is used during due diligence to assess investment opportunities’ expected social impact and alignment with CHC’s mission. The tool enhances CHC’s capacity to make informed investment decisions while increasing the impact of its portfolio. CHC staff use the social impact rating tool to synthesize quantitative and qualitative data points into quantitative social impact rating scores relating to the investment’s overall impact, impact on the investee, impact on residents, and impact on the community in which the project is located. The tool helps CHC answer the following questions concerning each dimension of impact:

"With such a robust impact rating tool that fits seamlessly into its internal processes, CHC has become one of the leading practitioners of impact management."

Justin Fier, Pacific Community Ventures, Managing Director of Research and Consulting

The Projects we Invest in Create Homes that are...

FY 2016-19

Affordable

91% of CHC Borrower's Properties are Affordable to Families Earning 80% of the Area Median Income (AMI) or Less

11% of CHC Borrower's Properties are Affordable to Families Earning 30% AMI or Less

28% of CHC Borrower's Properties are Affordable to Families Earning 31%-50% AMI or less

43% of CHC Borrower's Properties are Affordable to Families Earning 51%-60% AMI or less

10% of CHC Borrower's Properties are Affordable to Families Earning 61%-80% AMI or Less

Sustainable

54% of CHC borrowers’ homes, on average, are preserved structures using green features

Accessible

76% of CHC borrowers' homes are accessible via public transit (within a 10 minute walk of a train or a 5 minute walk of a bus stop)

Safe

CHC's borrowers' affordable housing protects residents moving out of substandard housing from physical and social threats

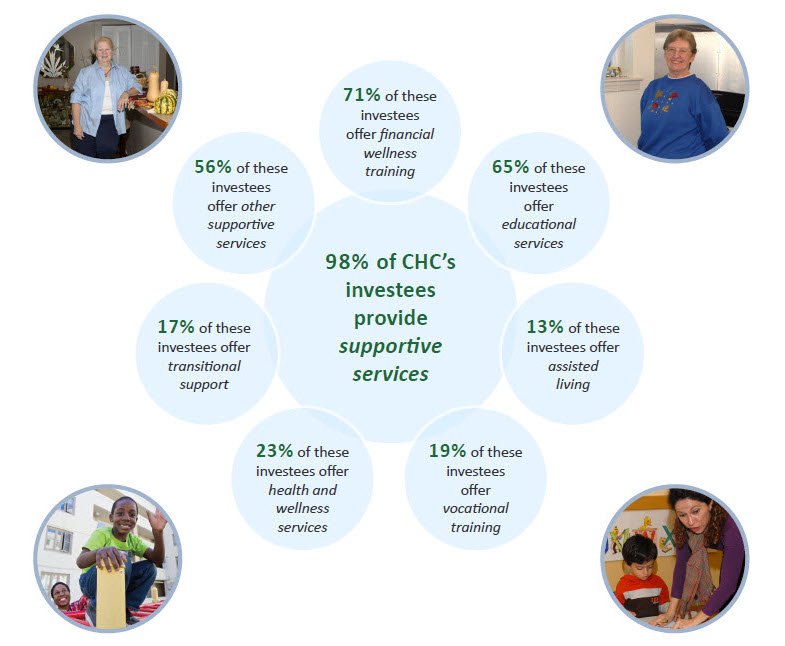

We Support Under-served Populations by Investing

in Developers that Provide Supportive Services

By supporting the expansion of affordable housing, CHC is contributing to the health and well-being of communities and progress towards

10 of the 17 Sustainable Development Goals.

In 2015, the United Nations Member States adopted a set of 17 goals as a shared blueprint for all countries to work together to improve health and education, reduce inequality, preserve our oceans and forests, and spur economic growth. More Information

Advancing Solutions

Advancing Solutions

CHC is Unlocking New Capital and Designing Impactful Services to Support the Important Work of our Borrowers

Click an Item Below for More Details

Value of a Trusted Partner

VALUE OF A TRUSTED PARTNER

I will always be grateful for the integrity and professionalism behind every person that I’ve ever known to work at Community Housing Capital. You can take that to the bank.”

Cathy Williams, CEO, NeighborWorks Columbus

In the midst of a pandemic, when the words “we’re all in this together” and “during these challenging times” are often thrown around like word candy on the nightly news, we are reminded of how words like “network” and “partnership” can be taken for granted. After 20 years of lending to members of the NeighborWorks® network, Community Housing Capital (CHC) knows first-hand the proven value of partnerships. CHC built its foundation on the support of people and organizations whose investments give us the flexibility to keep capital flowing to affordable housing, especially in challenging times.

“The first time CHC saved us was in 2008 when we were nearly brought to our knees by the economic crisis,” said Cathy Williams, President, and CEO of NeighborWorks Columbus (NWColumbus), a nonprofit affordable housing developer in Columbus, Georgia. “We had a $1.2 million line of credit called by our local banks as major financial institutions grappled with a frozen-credit environment. At the time, we had 14 houses in some phase of construction. There was no capital. All the banks pulled back. No mortgages were being extended. Nothing. But, in just one week, CHC refinanced the entire debt. Then, they patiently worked with us for almost seven years until we sold every home and repaid the loan. I will always remember how amazed my board was when CHC came to our rescue.”

“The second time CHC came to our rescue was very recently when COVID-19 turned everyone’s world upside down,” said Williams. “We had worked for over a year with a local bank to be our sponsor for an Affordable Housing Program (AHP) award from the Federal Home Loan Bank of Atlanta. At 11:00 am, on the day of the application deadline, the uncertainty surrounding the pandemic induced our local bank to pull back from deploying new capital. We were suddenly dead in the water,” she said.

“We immediately called Cindy Holler, president, and CEO of CHC. By 3:00 pm, we had our AHP application in front of CHC’s SVP and Chief Loan Officer, Dana Chestnut. By 6:00 pm, I received an email that said they had underwritten it and were comfortable to move forward. Our application was submitted just in time. Now, that doesn’t mean we’re going to receive the award. Still, I will always be grateful for the integrity and professionalism behind every person that I’ve ever known to work at Community Housing Capital. You can take that to the bank.”

The Federal Home Loan Bank of Atlanta conducted a study in 2018 that focused on the affordability gap in rental housing. Columbus, GA, was a city studied, and the data showed an affordability gap of over 14,000 homes. “This told us that our families are doing one of two things. They are either paying way too much of their income for housing or they are living in slum housing,” said Williams.

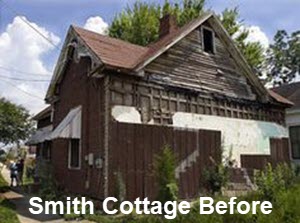

One example was an at-risk senior, Joceil Smith, discovered at 82 years old living in deplorable conditions, with huge holes in the side of her house. On the day she was rescued, her living room was 46 degrees and she was wearing every piece of clothing she owned.

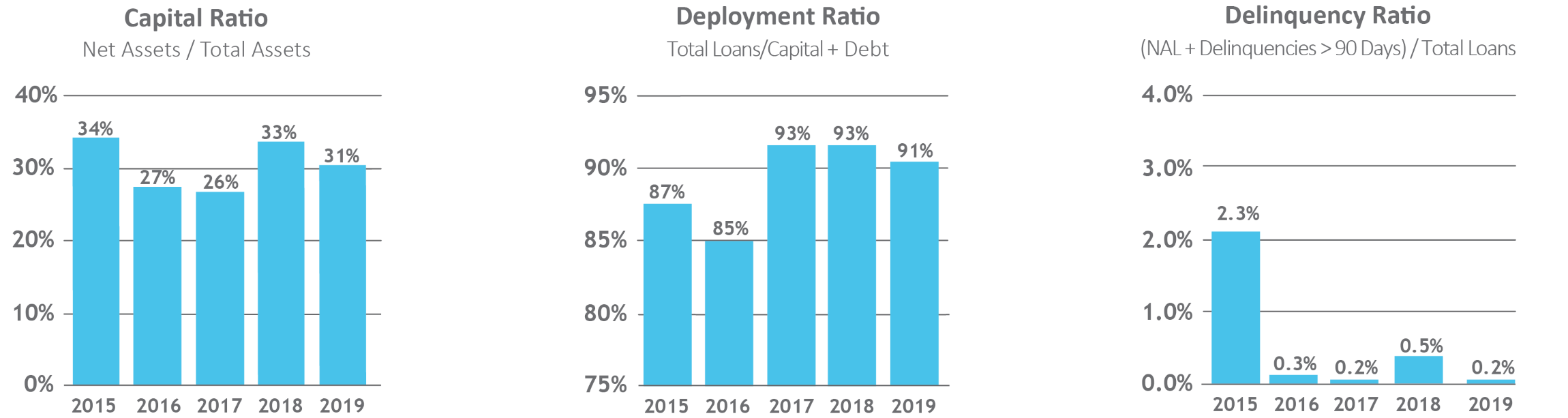

Financial Highlights

Financial Highlights

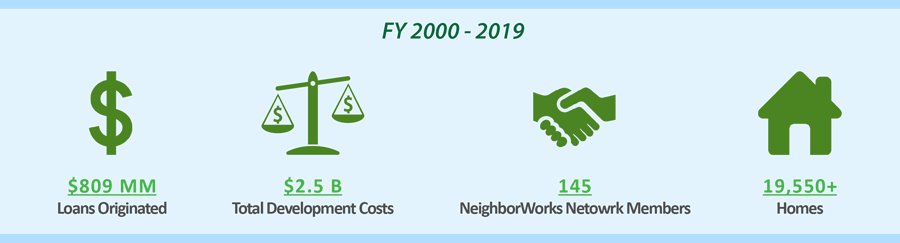

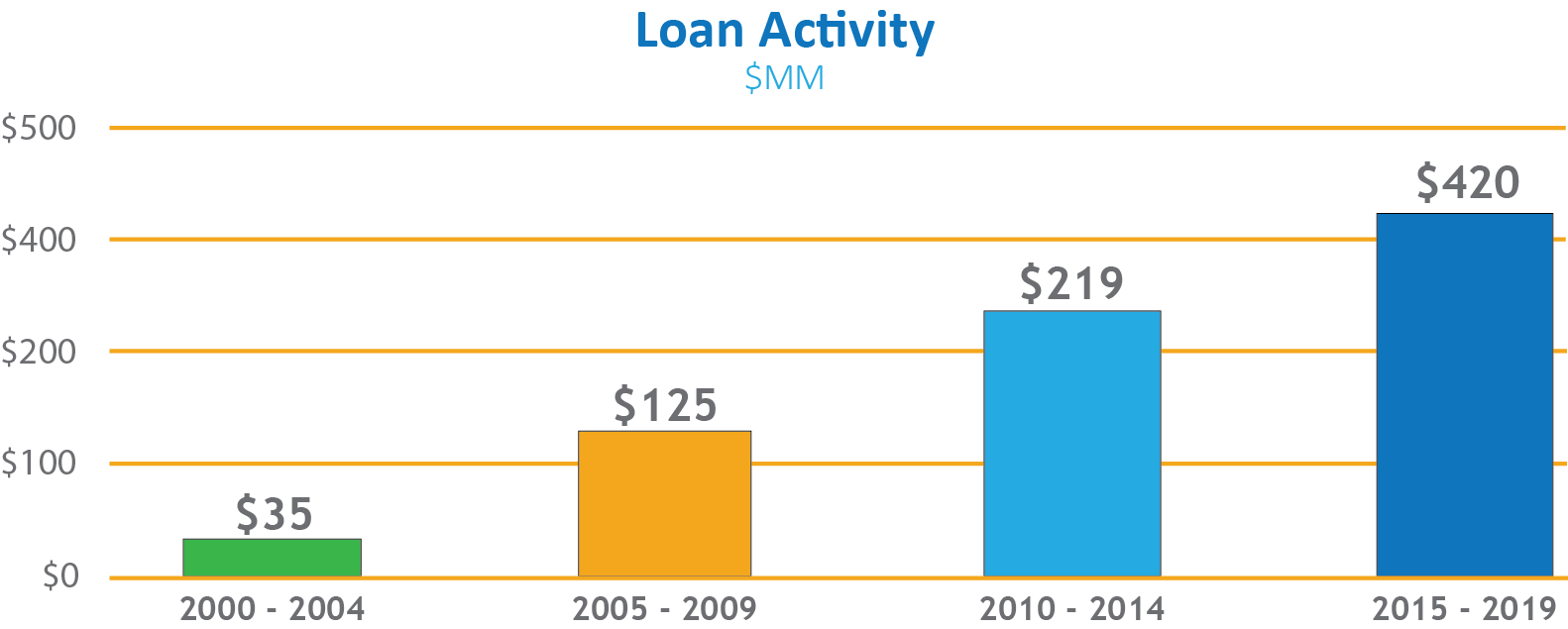

FY 2000-19

19,558 Homes Created or Preserved

Our mission will be fulfilled when every individual and family has a safe, quality, affordable place to call home.

Board of Directors

Board of Directors

Guidance for a Critical Mission

CHC’s Board of Directors is a team of highly experienced leaders who are committed to a mission with long-term ramifications to the well-being of our nation’s citizens. They are the guiding hand to our future growth, and we are proud to have some of the most talented business leaders in the affordable housing industry. Our board members are leaders, entrepreneurs, and visionaries from the nonprofit and banking sector who seek to create sustainable growth that will maximize the impact of our work for all our stakeholders and the communities they serve.

Select one of the date ranges below to view the composition of the board over our 20-year history

Chris Krehmeyer, Vice Chair

Business Planning Committee Chair

Loan Committee

President and CEO, Beyond Housing

Tom Bloom

Audit and Risk Committee Chair, Executive/Finance Committee

CFO, Retired, Office of the Comptroller of the Currency

Alan Ferguson

Audit and Risk Committee

SVP, Invest Atlanta

Corey Harris

Loan Committee

President, Neighborhood Housing & Dev. Corp.

Bruce F. Martin

Governance Committee

SVP, JPMorgan Chase Bank

Brian Robinson

Senior VP, Originations & Capital Markets

National Affordable Housing Trust (NAHT)

Daryl Shore

Business Planning Committee

Investment Manager, Impact Investments, Prudential Financial

Mary White Vasys

Business Planning Committee, Governance Committee

President & CEO Vasys Consulting

Affiliations

Leadership Team

Our Team

OUR TEAM

We believe our greatest strength is our team. We are passionate about our mission and bound by the belief that every person deserves a safe, quality place to call home. We are creative and tenacious innovators with a collective knowledge and depth of experience to solve complex problems and effectively deliver capital where it is needed most.

Cindy Holler

President and Chief Executive Officer

Arif Rizvi

SVP/Chief Financial Officer

Dana Chestnut

SVP/Chief Loan Officer

Alvin Saafir

SVP/Chief Credit Officer

Debra Turner

SVP/Chief Loan Administrator

Ingrid Avots

Senior Loan Officer

Donyetta Edwards

Loan Officer

Jan Adams

Senior Underwriter

Regina Claiborne

Loan Admin Officer

Neet Pulliam

Loan Admin Officer

Angie Waddell

Director of Impact & Loan Admin Officer

Wendy Gilbert

Senior Paralegal

Odessa Washington

Credit Administrator

Lori Burns

Office Manager

Bob Kauffman

Asset Manager

Donna Rush

Marketing Manager

Investors

Our Investors

CHC leverages investments from a wide range of socially responsible grantors and investors to help fund the community-based initiatives of the NeighborWorks® network. Our investors have a deep understanding of the nonprofit real estate developers we serve. With the support of this patient, flexible capital, we can offer attractive financing options; options that create and preserve affordable housing for our most vulnerable families and communities.